A merchant account is a special type of bank account that makes it possible for businesses to accept multiple payment types. Generally, it allows your business to accept debit card and credit card payments online, in-person, and over the phone.

Merchant accounts are established under you and your business (the acceptor) and a merchant acquiring bank for settlement of payment card transactions. In some situations, an independent sales organization (ISO), a member service provider, or a payment processor, are also part of the merchant agreement.

Whether you enter the merchant agreement directly with the acquiring bank or through an aggregator, you’re contractually obligated to obey all the operating regulations established by the card associations, which includes security measures.

Traditional brick-and-mortar businesses can go cash-only and then make regular deposits at their bank to bypass the need for a merchant account. To have any kind of successful online business, you must be able to accept credit and debit cards, so avoiding merchant accounts are not an option.

Merchant Account vs. Bank Account

A merchant account is a type of business banking account. However, it’s not a bank account that you’ll ever have direct access to. Merchant accounts require a partnership with a merchant acquiring bank that facilitates all the communications that occur as part of an electronic payment transaction.

Unlike a traditional business checking account, the merchant account acts as a kind of intermediary account. The payment processor deposits the funds into the merchant account. The funds sit in that account for one to three business days during processing.

During that time, the merchant services provider may release the funds to the merchant’s account in good faith. If for any reason the transaction doesn’t go through, isn’t valid, or if the card issuer does not disperse the funds, the funds may be reversed and taken out of the business account. It’s important to always have sufficient funds in the account to account for refunds you may have to process to customers.

Funds deposited into the merchant account have processing fees deducted, so you as the merchant will never receive the full transaction amount. The funds are automatically transferred on a daily or weekly basis.

What’s Required for Merchant Accounts?

Traditional merchant accounts require you to complete a merchant account application.

To do this, you’ll need:

- Business bank account

- Business license

- Financial statements

- Physical address

- Employer identification number (EIN)

- Articles of incorporation

- PCI compliance

- Supporting documents, such as business plan, business policies, marketing materials, etc.

Each traditional merchant account will have its own application process and set of requirements. To make sure you have what you need, call and ask. Most of them don’t have any issue telling you upfront what you need.

Why do you need so much? For every new merchant account that a partner bank approves, there’s a certain amount of risk involved. Because the merchant account bank releases funds to the small business account before the funds have fully cleared, such account acts as a kind of credit.

Some providers only provide the merchant account, while others offer the merchant account and payment processing. Make sure you know what the provider you’re interested in offers. If you want both from a single merchant account provider, it will help narrow down your choices.

How Do I Get a Merchant Account?

To get a merchant account of your own, you just have to meet the necessary requirements of each of the merchant services providers you’re applying with. The above list covers the majority of what you can expect to need. The more documentation you have to prove your business’s legitimacy and legality, the better off you’ll be.

When considering whether or not to approve a merchant account application, banks consider things such as:

- The type of business you’re running and its risk of credit card fraud and returns

- How long you’ve been in business

- Your business history – defaults, bankruptcies, etc.

- Whether you as an applicant have ever had a merchant account in the past

- Your personal credit history

If you’re a new business owner, you’ll be more likely to get your merchant account approved by the bank that holds your personal and business accounts. For some business owners, the underwriting process makes it difficult to get such account directly with a bank. That’s where working with a payment gateway like PayPal comes in. With it, you don’t need an official merchant account and you can still accept online payments. PayPal is your both your gateway and your merchant account.

When you apply for your account, don’t be afraid to shop around. You want to get the best possible rate. If the provider you’re considering isn’t accessible or transparent, look elsewhere. The best companies will provide quotes, help you through the application process, and have dedicated support available to assist you.

When you’re trying to decide which banks to apply with, ask these questions:

- Beyond processing fees, are there additional fees I need to be aware of? Installation and setup? Chargebacks? PCI compliance fees? Early termination fees?

- What are your funding times? 24-48 hours is the standard.

- What’s the average wait time if I need to speak to customer service? Are there customer support fees?

- Is there a minimum? If I don’t meet this minimum, are there additional fees?

- How often are my account fees debited from the account? Can I choose the frequency? Am I charged another fee if I do not have sufficient funds available to cover the fees?

- What kind of reports will I be able to generate?

- What do your current and future business development plans look like? Are there any new features you’re working on?

Once you get this information from multiple merchant account providers, consider conducting a cost-benefit analysis of your top choices, so you can see who comes out on top. It’s okay to go with your instinct, as long as all the necessary features are there at a price you can afford to pay. Ecommerce merchant fees vary from one provider to the next. You will always have to pay something.

Merchant Account vs. Payment Gateway

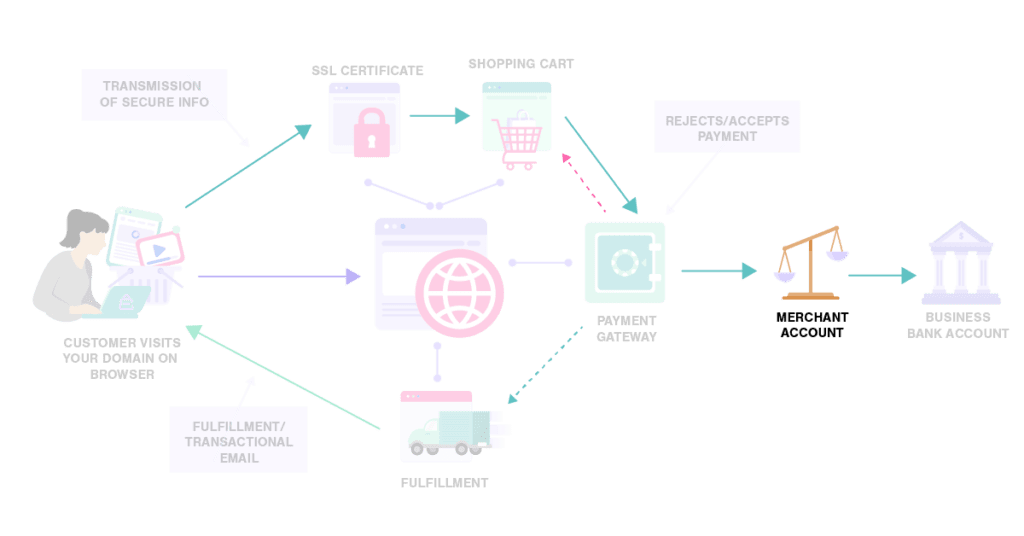

A merchant account is a piece of the payment gateway puzzle. It’s the account that the payment gateway sends the funds to.

A payment gateway is a technology that connects merchants to payment networks. It:

- Connects to your online store.

- Captures payment details

- Routes the information to the payment processor or acquiring bank.

- Sends the approval or decline message to the merchant.

Top Merchant Account Providers

Today, you’ll find it’s easier to accept payments online and in-person than ever before. In the past, many businesses that could accept credit cards online didn’t have an easy way to process credit card transactions in person. Now that payment service providers offer customers free or discounted card readers, online businesses can host popup shops – and small brick and mortar stores can combine online and offline inventory and payment management.

Today, many payment gateways and payment processors also offer merchant accounts to their customers. How? They leverage their power as a large payment service provider (PSP) to provide credit card processing options to small businesses. This way, you no longer have to worry about opening a merchant account directly with the bank of your choice. You’ll be able to process payments, either as a debit card transaction or a credit card transaction. You partner with the providers on this list, and the partners process data on your behalf.

Square

Square is one of the most popular options out there since you can also use it to build your online store. You won’t pay a setup fee or a monthly fee. You’ll get a free card reader, and can pay $10 for each additional reader you need.

What you’ll pay for payment processing depends on the nature of the transaction:

- In-Store Payment Fee: 2.6% + $0.10 per transaction

- Mobile Payment Fee: 2.6% + $0.10 per transaction

- Online Payment Fee: 2.9% + $0.30 per transaction.

If you need hardware to accept in-person payments, you’ll pay $299 for a credit card terminal and $799 for a cash register.

Square also provides a free mobile app that allows you to process payments without a card reader or terminal. It also includes customer management software that can collect customer feedback, which can help to generate audience insights. Square’s customer management software also makes it possible for a small business owner to launch a loyalty program.

The Square software makes it easy to handle other business tasks, such as:

- Inventory management

- Invoicing

- Employee tracking

- Sales reporting

Stripe

If you’re a business owner who wants more control over your customer’s checkout process, then you’ll want to consider the Stripe payment gateway. Many consider it the best option for online-only businesses. If you’re also a brick-and-mortar business, you won’t get as much from this service.

- Online Payment Fee: 2.9% + $0.30

- In-Person Payment Processing Fee: 2.7% + $0.05

Hardware is available, but prices vary. Stripe works with Verifone systems and other pre-certified card readers.

The mobile app makes it easy to accept payments and manage transactions. The software offers recurring payment features, and it can automatically update credit card information any payment methods that have been kept on file. You can offer customers installment payments as well as pay later options through Klarna.

PayPal

As one of the earliest online payment processors, it is also one of the most trusted. It’s similar to Square and Stripe, but the transaction costs are a bit higher. And, you can’t purchase any hardware.

- In-Store Payment Fee: 2.7% + $0.30 per transaction

- Mobile Payment Fee: 2.7% + $0.30 per transaction

- Online Payment Fee: 2.9% + $0.30 per transaction

Your first mobile credit card reader is free. Additional card readers are $24.99 each. There’s a free mobile app to accept payments. As far as customer management goes, customers can use their PayPal account to pay. For purchases over $99, PayPal offers financing. QR codes are available for contactless payment.

Braintree

Braintree Payments is a popular option among the major tech companies. Brands like Uber, Airbnb, Jet, and Yelp use it to process their payments. With Braintree, it’s possible to accept all major debit and credit cards, local payments, e-check (ACH) payments aka bank transfers, Venmo, PayPal, and digital wallets.

With all of the third-party integrations available, you can personalize your checkout process and keep it seamless for your customers.

The transaction fees are simple, too. You’ll pay 2.9%+30 cents (just like PayPal) per credit card or debit card transaction. ACH transactions are priced much lower at 0.75%. You won’t have a transaction fee for customers using PayPal or PayPal Credit.

Stax

Stax offers mobile point of sale (POS) readers, physical POS hardware, an ecommerce shopping cart, and more. Their software includes:

- Basic reporting capabilities

- Access to developer tools to customize the checkout process

- Some third-party integrations.

What makes Fattmerchant different from the competition I’ve listed here is its pricing structure. It is one of the few places to secure merchant accounts that uses subscription-based pricing.

Instead of using a pricing plan with multiple tiers, or an interchange-plus plan, Fattmerchant’s pricing structure allows businesses to get everything they need starting at $99/month. There is an $0.08 transaction fee, which is much lower than what many providers charge.

There isn’t an early termination fee or cancellation fee. You won’t have to pay a statement fee or batch fees.

You choose your subscription based on the kind of POS product you need: mobile POS, virtual terminal, EMV terminal, etc. Inside each of these categories, there are two subscription options:

- $99/month for businesses that process less than $500,000 a year

- $199/month for businesses that process more than that.

It’s worth mentioning, however, that if you want the Fattmerchant credit card processor for your online store and a brick and mortar location, you’ll have to sign up for the plans separately. For a small business, these monthly fees can be costly. But for large volume businesses, this approach can help save money.

Choosing Your Merchant Account Provider

Every merchant account provider will charge transaction fees, to cover the cost of payment processing. Some accounts may or may not charge a monthly fee, in addition to the transaction fee. Some may also charge chargeback fees.

When you choose the merchant accounts services provider you want to work with, consider:

- Monthly fees: You may not want a monthly bill. But, if you’re processing a high volume of transactions – the monthly fee may be cheaper than the transaction fees you pay. Run the numbers to see what’s more affordable for your business overall. Are there any extra setup fees or annual fees you need to budget for?

- What customers already use: If your customers are already using PayPal, it makes sense to offer it, too. But, it’s not necessarily as popular at the international level as it is in the United States. To keep the process as smooth as possible for your customers, it makes sense to work with a merchant account that makes it easy to accept payment methods that your customers are already using.

- Security: Does your payment gateway securely process personal data? Does the payment process do anything to affect browsing data?

- Is the payment gateway included, or will you have to invest separately?: Running everything on separate platforms complicates your workflow.

- The card networks you want to access: Many payment gateways cover Visa and Mastercard. But, if you want to be able to accept American Express or Discover, you may need to invest in additional payment gateways.

- Offerings: Does the company provide the POS systems you need? If you run a physical store, you’ll need a countertop or mobile solution you can use.

- Customer support: How easy is it to access the customer support team? How often are they available to help you should you have any issues?

- Industry-specific offerings: Does the company have any offerings that are customized to your industry?

Which Merchant Account Option is Right for You?

Whether you end up applying for a traditional merchant account or opt for an online option with a PSP, you need to be able to accept online payments. What really matters is the ease of use for you and for your customers.

There’s no single option that is “best” for all companies. What works well for a multi-million dollar company with an online shop and several physical stores will not be the same solution as someone who’s running a retail arbitrage business, or running their own Shopify store.